A client reported this week that one of his ex-stock vehicles, which had been used as a ‘run-about’ in his business for several years, was recently stopped by the Police using Automatic Number Plate Recognition (ANPR) technology for having no tax (RFL).

It seems that the dealer had managed to stay on the right side of the law and tax the motor without incident for about three years following an accident and its re-classification as a Cat D. The dealer was the original keeper so retained the logbook.

It transpired that post October 2014 and removal of the paper tax disc, the DVLA had, in its infinite wisdom and for reasons known only to them and presumably the Lord Almighty, taken it upon itself to remove the vehicle from its system due to the accident damage some four years earlier and not issue the usual renewal notice.

In the absence of such notice and no paper tax disc to remind him of the need to tax the vehicle it would seem that it slipped under the radar, until being pinged by ANPR.

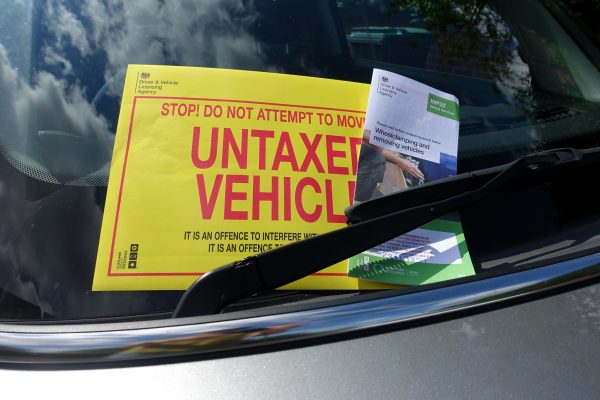

To the dealers horror he discovered that the vehicle had not been taxed post October 2014 and he now faces the prospect of a fine.

As for the DVLA, as quickly and inexplicably as it removed the vehicle from its system and by some magic it has now reappeared. It remains to be seen whether it will admit the error of its ways if the dealer is taken to task.

If the DVLA cannot be relied upon to provide suitable renewal notices then dealers running a fleet should ensure that they keep a proper record of the dates for MOT and tax renewal against each vehicle on the road.

What most people don’t know is that talent development doesn’t have to be complicated, high risk or expensive. Once they integrate key development stages, the results can be remarkable. Empower your team. Lead your industry. We’re your strategic learning partner, driving performance by moving skills forward.