During a perennial dispute over the use of trade plates our contributor has recently received yet another missive from the DVLA but on this occasion it contained a piece of information that despite his many years in the Trade, he was entirely unaware of.

After speaking to several other motor traders it became apparent that he was not the only one that was blissfully unaware of this particular piece of secondary legislation.

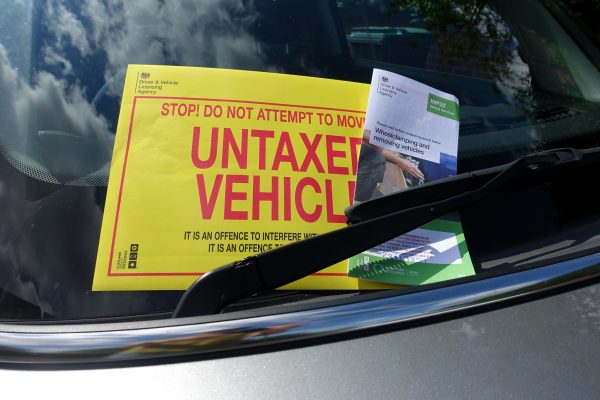

Under The Road Vehicles (Registration and Licencing) Regulations 2002, a dealer who has held a used car in stock for more than three months (not unusual) aka “the three months period of grace”, is required to register the vehicle in its name (PART IV, Regulation 24).

Consequently, a trader is not permitted to use trade plates on such vehicle after registration. Instead, the trader must tax the vehicle if it is to go on test drives and the like.

Last year over 8 million used cars changed hands and even if but a small fraction of those were overage stock held on garage forecourts, then that represents a potentially enormous number of vehicles, which might be affected by this regulation.

Our contributor highlights some serious implications to this piece of secondary legislation.

First, it can take up to six weeks for a V5 to be processed by the DVLA, during which time the car cannot be sold as it cannot be taxed. Effectively, it becomes dead stock.

Secondly, there is a trend for insurance companies to no longer automatically include “drive other car cover” in their policies. This means that a prospective customer would no longer be able to test-drive a car, as it would not be insured; and in any event such cover is intended to be used in an emergency only and not for those just popping out for a spin.

In the case of drivers under 25, a great number of which are in the used car market, it is pretty much a given that such cover is excluded; ergo, the car becomes virtually unsellable, unless the dealer is prepared to flout the law.

Lawgistics are most grateful for the valued contribution of Douglas Munday of Central Motor Company, Kettering on this subject and welcome further contributions on this and any other issues affecting traders.

Impression works with businesses across the automotive aftermarket supply chain such as parts suppliers, warehouse distributors, motor factors and independent garages. Covering all aspects of automotive aftermarket marketing, including social media, event management, customer newsletters and PR, Impression is able to quickly establish itself within a client’s business and work towards their objectives.