As most of you will know 1st October 2014 is ‘D- Day’ for the RFL changes.

Here are a selection of the most pertinent and frequently asked questions on the subject, as answered by the DVLA:

Q. Given that paper tax discs no longer need to be displayed from the 1st October how will a vehicle repairer know if a car is taxed for the purpose of test drives?

A. Check at www.gov.uk/check-vehicle-tax but if in doubt as to the vehicle tax status use trade plates for day to day business otherwise an unsuspecting repairer may be prosecuted for driving an untaxed vehicle.

Q. At what point does it become the responsibility of a new owner to tax the vehicle?

A. As soon as the customer purchases a vehicle and decides to become the registered keeper on DVLA records they must tax immediately. They do not need to wait for the Registration Certificate (V5C) to be in their name to tax.

Q. If a car dealer is sitting with cars in stock with current and valid tax, what happens to the tax on 1st October since these cars will be ‘in trade’ and have no current keeper?

A. Any vehicle currently in the motor trade with a valid tax disc will continue to be taxed until the vehicle is sold. At that point the present tax will terminate. No refund will be paid where the vehicle is recorded as in the motor trade. For any refund to be issued there must be a registered keeper held on DVLA records. This has been the case since 2009.

Q. Can car dealers continue to tax vehicles for customers on their behalf?

A. Yes, by using V5C/2, either online at https://www.gov.uk/tax-disc using the V5C/2 of the V5C, by telephone on 0300 123 4321, or at a PO branch that deals with vehicle tax.

Stocking only premium EV charging cables, we ensure you experience a stress-free EV charge, over and over, confidently backed by our 2 year warranty. Our premium & reliable charging cables are compliant with EU & UK safety standards. We offer free next day delivery* on all EV charging cables when shipped within mainland UK.

Q. How will the tax change affect vehicle auction companies?

A. Vehicles transferred to an auction company will be untaxed from 1 October. Once the seller informs DVLA that they have sold the vehicle they will receive an automatic refund. The buyer will need to tax the vehicle using V5C/2 before they drive it away from the auction house, online or by phone as noted above.

Q. Can dealers use existing stock as ‘staff cars’ if they retain a valid tax disc?

A. No, dealers will have to register in their own name and tax the vehicle. Dealers have always been required to register vehicles in their name if they wish to use them for staff or personal reasons. If used for a valid ‘trade plate’ reason, then the current trade plate rules apply and the vehicle does not need to have tax. For further information go to https://www.gov.uk/trade-licence-plates .

Q. Do existing paper tax discs issued need to be visible from 1 October?

A. No.

Q. Can we perform a change of keeper online?

A. Not yet, but DVLA will introduce this soon. As noted above you do not need to be the registered keeper to tax. From 1 October you can use the new keeper supplement of the log book.

Q. When can we pay car tax by direct debit?

A. Starting from 1st November 2014.

Q. If a registered keeper does not apply for a refund when selling a vehicle to a motor trader before October will an automatic refund be issued for the remaining duty once DVLA is notified of a new keeper after 1 October?

A. Yes, an automatic refund will be issued to the previous keeper once a new keeper notification is received after 1st October.

Q. Do cars in dealer stock, which are not taxed need to be SORN?

A. No, if registered ‘in the trade’ and kept on private land then SORN is not required. Trade plates can be used to demonstrate a vehicle.

Q. Can we legally drive a car to an MOT testing garage without tax?

A. Yes, providing the MOT test is pre booked.

Q. If a car is currently marked in trade and has a valid tax disc until sometime in 2015 will that tax be valid if the car is sold after October 2014?

A. No, the existing tax will terminate on the day the car is sold after 1st October. Any refund of tax will be issued to the previous keeper. If the trader wishes to receive the refund, they must have registered the vehicle in their name before 30th September.

Q. Is there any way for a dealer to check whether a car is ‘in trade stock’?

A. There is currently no way for a dealer to check this. DVLA are aware of vehicles held in trade stock and are investigating how that information might be made available to dealers.

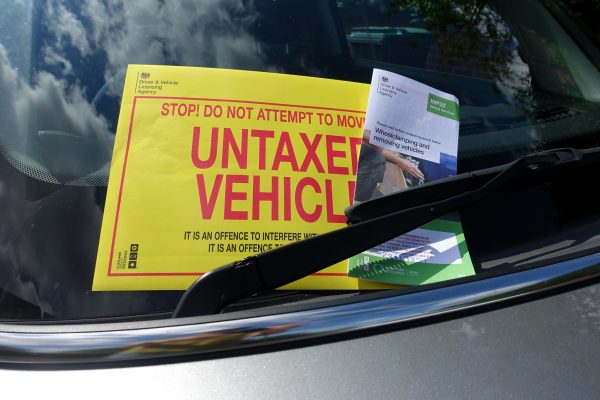

Q. What is the fine issued to a registered keeper for using a vehicle without valid tax?

A. Up to £1000.

Q. What is the method when selling a PX/trade car to a trader that is not being taxed in their name?

A. The process is unchanged. There is no need to notify DVLA. Trade plates should be used if the vehicle is used on the road for test drives, delivery etc. There is no requirement for a dealer to tax a vehicle in their stock unless they want to use it for example as a staff car.

Q. Since trade discs are to cease can we 1) remove the triangular and destroy the tax disc from 1st October as with standard tax discs, and 2) remove the screw held triangle top section from the front of the plate?

A. Yes, there is no requirement to display anything in the triangular holder after the 1st October.

Q. Can a car currently taxed and ‘in trade’ be parked legally on the road?

A. No, a vehicle must be registered to a keeper and be taxed before it can be parked legally on the road. If the vehicle is notified as ‘in trade’, the vehicle must be used for day to day business under the cover of trade plates.