There is a lot of disquiet about the lack of publicity over the new Road Tax/Road Fund Licence (RFL) rules coming in to play on 1 October 2014 (that’s just over one month!).

Essentially the new scheme is designed to move away from the use of a piece of paper (the tax disc) to show the RFL has been paid, to the use of electronic cyberspace to hold the information. In this way electronic systems (Automatic Number Place Recognition ANPR) will ‘clock’ cars on the road and flag up if the car hasn’t got the RFL.

If a customer is buying a car from you they will need to buy RFL straightaway or risk a fine. Payment will need to be made either on the DVLA website, on the phone or at a Post Office branch. Dealers can use their laptops and PCs to their advantage here to ‘seal the deal’ by generously offering the use of a PC to tax the vehicle, the customer will hopefully be more committed to buy. It’s a very straightforward process to renew RFL online.

If a customer is selling their car to you e.g. part exchange then the old practice of selling it with RFL has gone. RFL cannot be transferred with the car. DVLA must be notified of the sale and refunds of payment will be for any complete calendar months left for the licence period. Savvy customers might haggle to get the date at the month end.

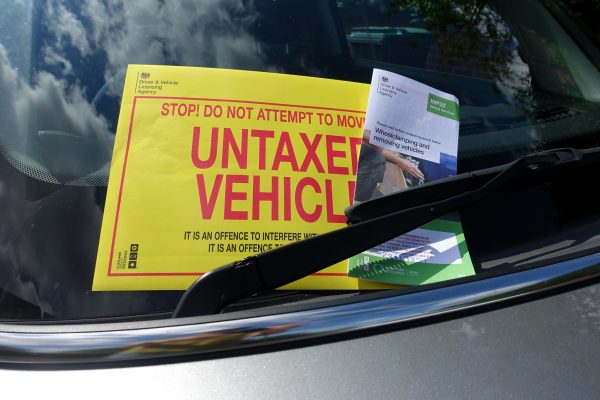

A big change for dealers will be the old practice of using a part exchange car with “a bit of tax on” as a loan vehicle. You can check online with DVLA to see when a vehicle becomes untaxed. It may be a good time to see whether you have enough trade plates to cover all eventualities in demonstrating vehicles.

Need help with keeping on track with FCA Regulation and Compliance? Partner with Automotive Compliance