Our member made no statement in their advertisement as to whether the vehicle was HPI clear.

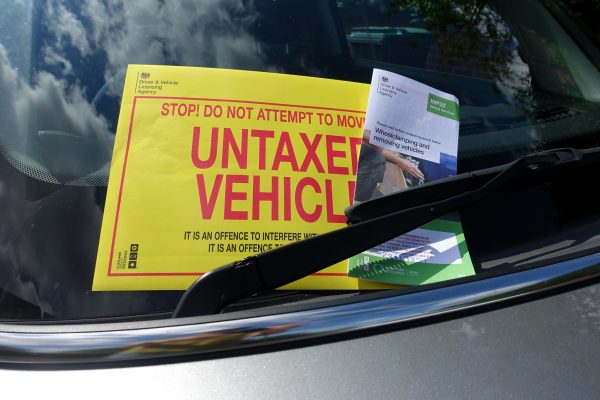

It was clear, but this was not mentioned either way in the ad. A few months after purchase, the buyer complained that the car was a Cat S according to the DVLA. Our member carried out another check, and it did indeed show as a Cat S.

Our member questioned why the original check prior to sale had not flagged this, and received an email from the data company stating that the Cat S marker had been placed in error by the insurers and had now been removed. Sure enough, another check confirmed the vehicle was clear.

Almost a year later, the buyer submitted a county court claim. In their defence, our member relied on the confirmation from the data company that the marker had been an error and that there had been no misrepresentation. By this time, however, the marker had reappeared. Despite this, our member believed it was not a clear-cut case and decided to defend the claim.

Furthermore, the vehicle was clearly not of unsatisfactory quality, having been driven nearly 10,000 miles by the claimant. It also passed an MOT during their ownership.

Interestingly, the judge held that our member was liable under section 11 of the Consumer Rights Act 2015, which requires goods to match their description. The judge determined that by describing the car as “beautiful” and “lovely,” our member had made a representation. The court also accepted that the vehicle was a Cat S and advised our member to take the issue up with the data company. The claimant was awarded a refund, with a small deduction for their substantial use of the car.

There are numerous car check companies in the UK, pulling information from sources such as the Association of British Insurers, the DVLA, and the police. Vehicles may not have official insurance markers but could still have suffered significant damage, been repaired, and re-entered the market. We are increasingly seeing claims involving “salvage markers,” old accident photos, and even footage of vehicles in floods.

Traders can argue, as in the case described, that no statement was made or that a car is “HPI clear” (with HPI being a brand name now synonymous with insurance checks). However, in today’s data-rich environment, vehicle provenance is about more than just whether an insurance claim was made.

If you have had a similar issue or are facing a claim due to data discrepancies, speak to our legal team. Lawgistics members also benefit from access to up-to-date sales paperwork and legal support to help navigate these complex situations.

Leading experts in print, promotional clothing, staff uniforms, branded merchandise and PPE. Involution is your brand partner for promotional marketing and workwear, a one-stop-shop for your branded marketing needs for any business size and industry.